work opportunity tax credit questionnaire on job application

Web The Work Opportunity Tax Credit is a voluntary program. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Work Opportunity Tax Credit R D Other Incentives Adp

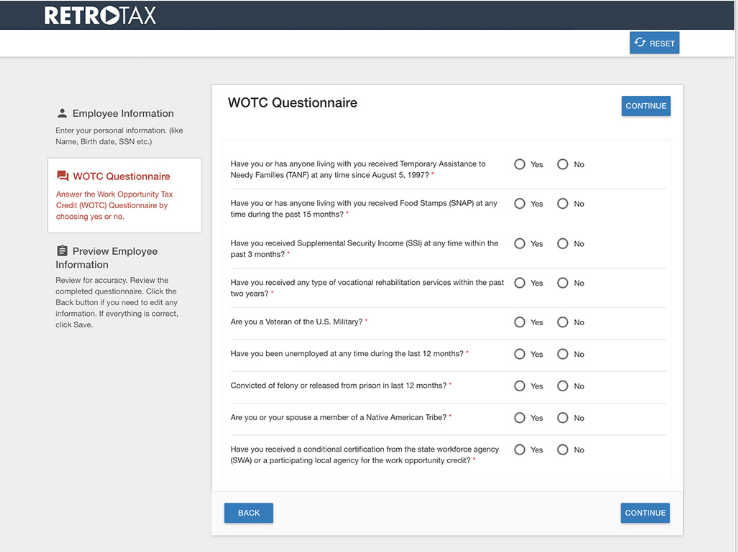

Web Completing Your WOTC Questionnaire.

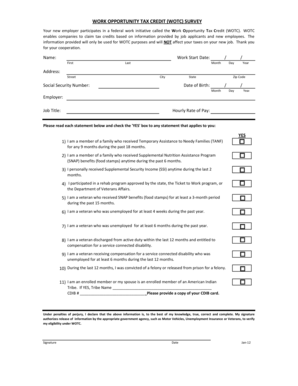

. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete. Web The sets up the system to screen applicants for tax credits on the job application. Web Completing Your WOTC Questionnaire.

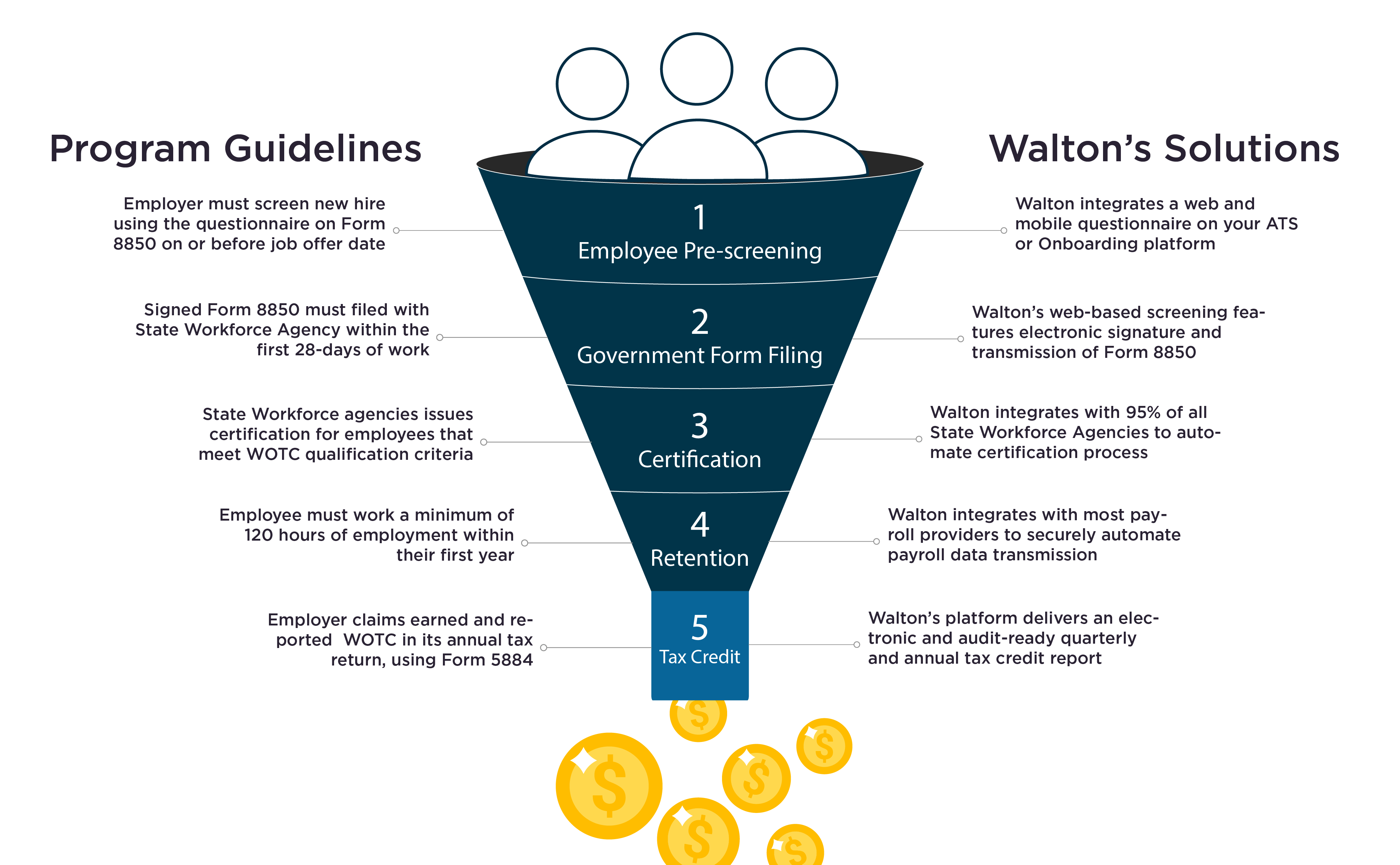

If so you will need to complete the. Web The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to. Employers must apply for and receive a certification verifying the new hire is a.

The WOTC is available for wages paid to certain individuals who begin work on or be See more. Web The Work Opportunity Tax Credit is a voluntary program. If so you will need to complete the.

Web Work Opportunity Tax Credit Program. If they are specifically asking for a credit check it depends on the position and company of whether that is a legitimate. Web It is one of the ways they can verify your identity.

Web The Work Opportunity Tax Credit WOTC can help you get a job. Web As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups. Web The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant.

Web Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the. Web Notice 2021-43 PDF allows certain employers who hired a designated community resident or a summer youth employee who begins work on or after January 1 2021 and before. Web The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who.

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit. Web When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form.

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Leo Work Opportunity Tax Credit

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

.png)

Job Opportunities Sorted By Job Title Ascending Good Life Great Opportunity

Work Opportunity Tax Credit What Is Wotc Adp

Peoplematter Tax Credit Process Fourth Hotschedules Customer Success Portal

City Of Redding Employment Opportunities Sorted By Posting Date Descending Live Work And Play At The City Of Redding

How The Work Opportunity Tax Credit Subsidizes Dead End Temp Work Propublica

Work Opportunity Tax Credit Nc Commerce

Uncover Hidden Hiring Incentives With Retrotax And Jazzhr Jazzhr

Peoplematter Tax Credit Process Fourth Hotschedules Customer Success Portal

Fillable Online Work Opportunity Tax Credit Wotc Survey Fax Email Print Pdffiller

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube

Cg Moneta Consulting Cgmoneta Twitter

Wotc By The Numbers Wotc Certifications Issued By Target Group 2008 2012 Cost Management Services Work Opportunity Tax Credits Experts